Interest Rates and Asset Values

It seems like everyone is talking about interest rates. We’ve fielded a lot of questions and recently wrote a “What We Are Thinking About” memo that outlined several potential implications of interest rates turning higher. The most obvious and intuitive is the cost of borrowing money, but the implications are far-ranging. As Warren Buffet succinctly put it, “Interest rates power everything in the economic universe.”

With that in mind, we wanted to spend a few minutes reviewing one of the more difficult implications of higher interest rates: lower assets values.

Asset Values

When buying an asset like farmland, you are essentially buying the rights to a stream of annual earnings. There are three primary considerations around the valuation of that asset: 1) what is the asset’s value? 2) What are annual earnings? And 3) what is the capitalization rate? This is a bit like your high school math class, where if you know two of the variables, you can solve for the third.

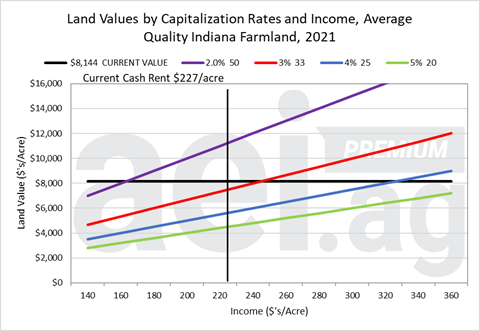

Figure 1 plots the relationship between these variables for average-quality farmland in Indiana in 2021. First, the black lines represent farmland values ($8,144 per acre) and the annual cash rental rate ($227 per acre). This computes to a capitalization rate of 2.79%, which is the lowest observation going back to the late 1970s.

This chart is also useful to examine how changes in rental rates, values, or capitalization rates would affect each other. Consider the purple, red, blue, and green lines, which each represent a combination of farmland values and cash rental rates that would generate underlying capitalization rates. For instance, if farmland capitalization rates were to increase to 3% (red line), it would require rents to increase from $227 per acre to $240 per acre (where the $8,144 valuation line intersects the red 3% capitalization rate line). Such a change would not seem to require such a big shift in the market.

On the other hand, if rates were to increase more substantially, much bigger changes would be required. For example, consider if capitalization rates were to increase to 4% (the blue line) from their current level of 2.79%. Under this scenario, a cash rental rate of $320 per acre (almost a $100 per acre increase in rent) would be required to maintain farmland values at $8,144 per acre. Alternatively, if rental rates were to remain at $227 per acre, values would have to fall from $8,144 per acre to $5,675 per acre.

Figure 1. Land Values by Capitalization Rate and Income, Average Quality Indiana Farmland, 2021.

Wrapping It Up

There is no way of knowing which combination of farmland values, cash rental rates, and capitalization rates the future might have in store. However, Figure 1 is a helpful mental model for considering potential “what-if scenarios.”

Stepping back from the numbers, there are a few key lessons. First, small changes in interest rates and capitalization rates (less than 100 basis points) would have minimal effects and could be easily tolerated. In other words, small adjustments would not require big changes in rents or values.

Second, large changes in interest rates (over 100 basis points) would likely require more significant changes. Given rates are very low, the effect on valuations could be significant. An additional consideration would be how quickly a change in rates might unfold.

Lastly, this exercise considers single adjustments. In reality, the farmland market will be adjusting to simultaneous changes in capitalization rates and cash rents. This is important because changes in the farm economy outlook – i.e., cash rents – could exacerbate and dampen any adjustments in farmland values. For instance, we’d expect big changes in the farmland market to occur when 1) cash rents increase and capitalization rates fall, or 2) cash rents decline and capitalization rates turn higher.

This summer, Purdue will release the 2022 survey and data. In addition to changes in farmland values, we’ll also be carefully monitoring cash rental rates. The bottom line to us is that farmland values appear to be priced as high relative to cash rents as at any time in the history of the Purdue series. Looking ahead, it will be critical to see how this relationship unfolds into 2022.